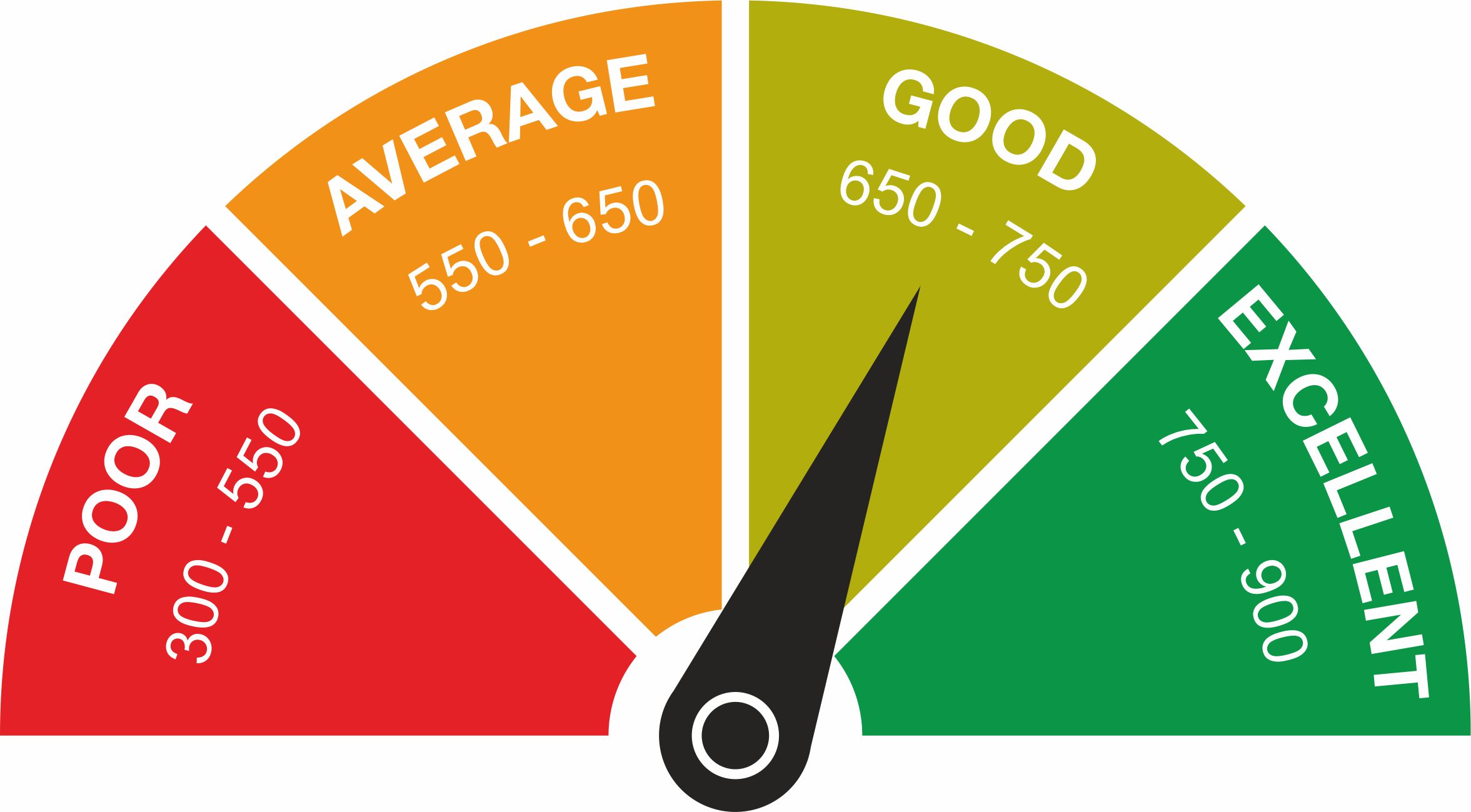

At VARDHMAN TAXCON, we offer expert CIBIL rectification services to help you improve your credit score and financial health. A good CIBIL score is crucial for securing loans, credit cards, and favorable interest rates. However, errors in your credit report can negatively impact your score.

Our dedicated team specializes in identifying discrepancies in your CIBIL report, such as incorrect personal information, missed payments, or outdated account statuses. We provide a comprehensive analysis of your credit report and guide you through the rectification process, ensuring that all inaccuracies are addressed promptly.

We assist you in preparing the necessary documentation and submitting requests to CIBIL for corrections. Our goal is to help you achieve an accurate credit profile, enhancing your chances of obtaining credit when you need it most.

With our CIBIL rectification services, you can take charge of your financial future. Whether you're looking to secure a home loan, car loan, or any other credit facility, we are here to support you every step of the way. Trust [Your Site Name] to help you clear up your credit report and improve your financial standing. Contact us today for a consultation!

A better CIBIL score offers several significant benefits:

- Easier Loan Approval: Lenders are more likely to approve loans and credit applications from individuals with high CIBIL scores, as they indicate a reliable borrower.

- Lower Interest Rates: A good credit score often qualifies you for lower interest rates, which can save you a substantial amount of money over the life of a loan.

- Higher Credit Limits: With a better score, you may be eligible for higher credit limits on credit cards and loans, providing you with greater financial flexibility.

- Better Negotiation Power: A strong credit score gives you leverage to negotiate better terms and conditions with lenders.

- Increased Chances of Rental Approval: Landlords often check credit scores during the rental application process. A good score can increase your chances of securing a rental property.

- Insurance Benefits: Some insurance companies consider credit scores when determining premiums. A higher score may result in lower insurance costs.

- Improved Financial Opportunities: A good CIBIL score opens doors to various financial products, including premium credit cards and personal loans with favorable terms.

- Peace of Mind: Knowing that your credit score is strong can provide peace of mind and confidence in your financial decisions.

Maintaining a good CIBIL score is essential for achieving your financial goals and securing better opportunities in the future.

Documents Required

FAQS

Our Packages

.jpg)